Nov. 7. 2022

Why is Mexico important for North America’s resilience?

Global manufacturers, logistics providers, and investors are looking to diversify their sourcing, production, and supply chain options, and many are giving Mexico a closer look. This is because the US ports and rail ramps are still experiencing congestion, and because trade and geopolitical tensions with China aren’t showing any signs of easing.

Its geographic proximity, multimodal infrastructure, and cost advantages have helped to create a global manufacturing and transportation hub with exclusive access to North American consumer and industrial markets. Mexico is already the second-largest US trading partner with a combined two-way trade of $661 billion in 2021. Mexico enjoys unique benefits from its commercial relationships with North America through the US-Mexico-Canada Agreement (USMCA) and other regional trade pacts.

Resilient Supply Chain

COVID-related supply–demand dislocation, amplified by natural disasters, has left US manufacturing supply chains reeling amid congestion, shortages, and delays. Low-probability events in 2020 and 2021 have highlighted the need to build redundancy and rapid response capability in the event of sudden disruption, as well as to better distribute risk across supply networks, from freezing temperatures halting petrochemical and semiconductor production, and a grounded container ship blocking the Suez Canal for two weeks.

In this context, Mexico is able to add value on multiple levels: Supplier diversification, product portfolio expansion, and “just-in-case” inventory buffers are some solutions to quickly pivot and absorb potential shocks.

Transportation: The resulting labor, equipment, and market dislocation, especially in Southern California where 40% of US waterborne imports enter the country, persist today due to a combination of pandemic, climate events, and the rise of e-commerce that caused a massive “bullwhip effect” of sudden, back-to-back collapsing and surging of demand over 2020 and 2021, on an unprecedented global scale.

With competitive rates and quick transit times during peak season and congestion, Mexico, which already has a healthy trade relationship with China, is well-positioned to act as a safety valve for overflow port traffic that is being transshipped into the US by truck or rail.

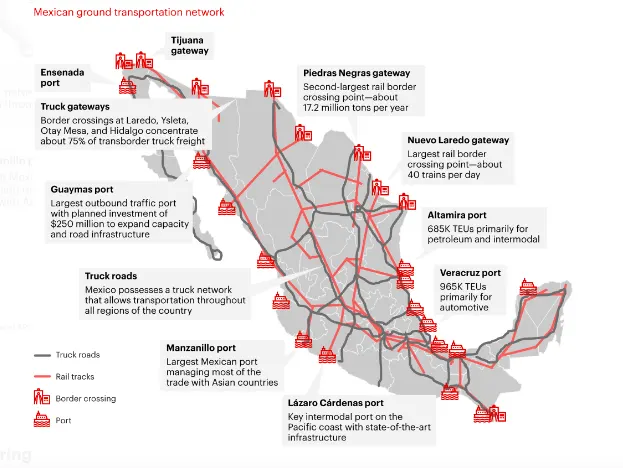

Mexico has a robust multi-modal infrastructure: 8 Key rail gateways and 15 federal ports

Note: TEU is twenty-foot equivalent unit.

Sources: Railway statistical Yearbook 2020, SCT and ARTF; SCT; DICEX website; TyT website, 2021; Kearney analysis.

Mexico Transportation Network:

76 Airports.

117 maritime ports.

3.1K Km Mexico-US border

11 truck gateways and 393K km of roads

7 rail gateways and 27K km of railway tracks

Improve now the efficiency of your supply chain.

Book a free consultation with a Fr8App Expert and optimize your results today.

Manufacturing / nearshoring

Before COVID, Mexico was already a draw for Chinese manufacturers, who started moving their production overseas in 2017 and 2018 to avoid rising tariffs. The trend was accelerated by China’s aging workforce and steadily rising wage, land, power, and commodity costs.

US companies that locate production in Mexico can save up to 80% by producing there rather than in the US thanks to lower wages and a typical 48-hour work week. However, Mexico now also has a cost advantage over China that is steadily growing. The nation competes with nations like Vietnam and Indonesia in luring Chinese businesses serving North American markets thanks to a robust manufacturing base and a younger, skilled labor force. Medical supplies, aerospace components, and electronics are three major industries that have expressed interest. The government is promoting locations in Mexico for semiconductor manufacturing, largely in support of cross-border automotive operations.

Manufacturing Labor costs in China are expected to surpass Mexico’s across ranks in the next 5 Years

Average worker costs, HIS

Sources: Kearney analytics

A recent example: Toymaker Mattel is spending $50 million this year to consolidate production in Mexico and North America in an expanded plant in Nueva Leon, Monterrey, in order to lessen its presence in Asia. An estimated $3 billion in production has been moved from Asia to Mexico since the start of 2021 by multinational corporations like Boeing, GM, Honda, Nucor, Oster, Samsung, and Stanley Black & Decker.

Investments

The Tehuantepec Isthmus Rail Corridor, which connects the ports of Coatzacoalcos and Salina Cruz as a potential substitute for the Panama Canal, and the ongoing development of five regional intermodal port coastal systems (SIPCOs), which combine networked ports with associated industrial parks, logistics hubs, inland ports, and supporting infrastructure, are among the projects for which the Mexican government has committed $38.6 billion in 2022.

The cross-border track-sharing agreement Kansas City Southern has with the ports of Lazaro Cardenas, Tampico, and Veracruz through 2037 has recently been extended for another ten years. In exchange, KCSM’s subsidiary in Mexico will contribute up to $195 million to the construction of a bypass for the city of Celaya in Guanajuato State, which will shorten travel time by removing 15 grade crossings.

Strategy is essential

Planning carefully is crucial, and should be based on an honest assessment of a company’s current situation, operational strengths and weaknesses, and strategic objectives across a range of time horizons, weighed against any potential advantages Mexico might present. Process automation and digital technology will play a significant role in the orchestration, visibility, and performance of the supply chain. With a solid history and presence in the Mexico and US markets, Fr8app brings manufacturing and cross-border OTR freight expertise. Let’s get going.

Discover exciting stories and get insights from logistics experts.

Join the ultimate Fr8App Insights mailing feed.