Nov. 23. 2022

This Week in Logistics

The Fr8app weekly market update, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT.

We know that market data is vital to making real-time business decisions, and at Fr8app, we are committed to giving you the data you need to better manage your freight.

What has changed?

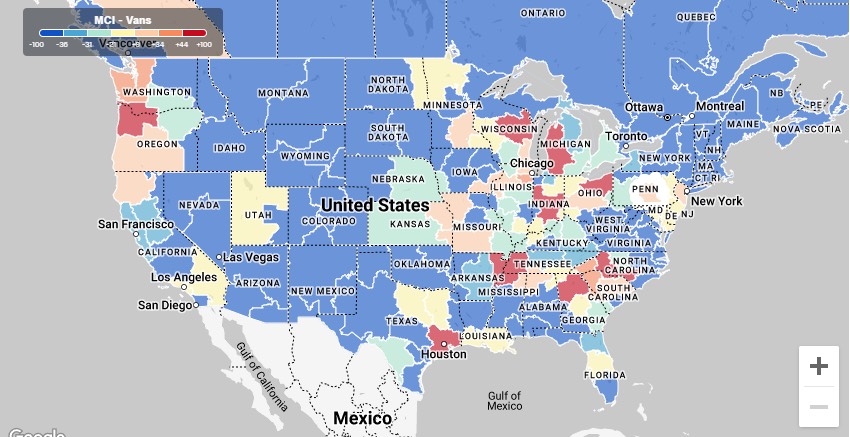

Since last week the market has warmed regionally mostly due to the winter storm in the North Central and North East. As well as in the PWN. If you are looking at other specific regions on the heat map you will see a mix of changes: some regions warmed but most stayed cool, specifically the key areas that we ship out of.

What’s happening out there?

- The Southeast, Central TX, Northeast remain warm and continue to face some capacity limitations but we should be seeing favorable buying power against this current market. Conversely, the West coast OB remains open with minimal impacts to coverage currently being reported.

- Capacity constraints continue among specialty equipment such as Flatbed, Reefer, HAZ, etc.

- In general the Top 3 tightest markets for capacity over the last 7 days – Northeast region, Southeast region, and the Southcentral regions of the Country. In addition, there are a few hotter markets to make note of, which would Include Elizabeth, NJ, Grand Rapids MI, Cleveland OH and Green Bay, WI.

What are we still seeing?

There are some areas in parts of the country you will see showing red or hotter on the heat map, with capacity a little tighter:

-

- In the Western Region of the country, we should have open capacity throughout the market.

- In the Northeast we are seeing Elizabeth, NJ, Harrisburg, PA, Philadelphia, PA and Allentown, PA markets.

- In the Southeast such as Memphis, TN, and Metro Atlanta, GA.

- In the Northcentral such as the Chicago/Joliet, IL, Grand Rapids, MI, Terre Haute, IN, Indianapolis, IN and all Ohio markets.

- The Southcentral region such as Mc Allen, TX, Houston, TX and Fort Worth, TX markets show tighter capacity.

Improve now the efficiency of your supply chain.

Book a free consultation with a Fr8App Expert and optimize your results today.

How should I read this map?

- Heat Map shows all markets in the Country and how those markets show where we have capacity rich areas and where we do not. The darker shaded red areas are the “hotter markets” that signifies more freight posted than trucks available in that area. The lighter areas represent more balance in a market for loads per truck.

- Generally, when you are looking at a hotter freight market, carrier rates inflate from demand. You will see increased rates in a more balanced or lighter market.

A good rule of thumb is…

- A lane from a balanced market to hot market will have stabilized rates.

- A lane from Hot market to a balanced market will have increase.

Key Locations with limited capacity

- Indianapolis, IN 2.8 L/T

- Laredo, TX 2.7 L/T

- McAllen, TX 4.9 L/T

- Macon, GA 3.5 L/T

- Harrisburg, PA 2.6 L/T

- Charlotte, NC 2.8 L/T

Key Locations with available capacity

• Atlanta, GA 2.4 L/T

• Chicago, IL 1.9 L/T

• Dallas, TX 1.8 L/T

• Ontario, CA 1.6 L/T

• Fort Worth, TX 2.4 L/T

Discover exciting stories and get insights from logistics experts.

Join the ultimate Fr8App Insights mailing feed.