July 20. 2023

This Week in Logistics

The Fr8app weekly market update, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT.

We know that market data is vital to making real-time business decisions, and at Fr8app, we are committed to giving you the data you need to better manage your freight.

What is going on in the US market?

Unfortunately, there is really not a ton to report on for this week. No major happenings or insights on the market as of today. That being said, we should see some changes coming regarding the Teamsters Union and the various collective bargaining agreements that they are working on. Primarily with UPS and Yellow freight. When everything is sorted out these will likely have large effects but just haven’t happened yet.

Also just to talk about the market regionally in the US the average regional rates have never been closer since I’ve been observing them. With the exception of the Northeast, all other regions of the US average van rates are within 11 cents of each other. Specifically:

Northeast $1.79 avg rate / mile.

Southeast. $2.11 avg rate / mile.

North Central $2.19 avg rate / mile.

South Central. $2.11 avg rate / mile.

West Coast $2.08 avg rate / mile.

These numbers do really mean much because rates are going to be more specific to various lanes but what this does do is it shows how far rates have come down since last year with the average rate in the US at $2.63 last July to the $2.053 that it is this week

As we have become accustomed to, the positive side capacity is still very open in most regions that should give us great buying opportunities against the market.

National numbers, Last week compared to this week, which are still skewed because of the holiday.

• Spot Load posts are up 31%

• Spot Truck posts are down 26.7%

• With Van rates are down 0.7%

Regional Fuel Rates from (https://www.eia.gov/petroleum/gasdiesel/)

Fuel Is up about 0.005 per mile or up about 1% over last week

- US Average: 0.44 /Mile

- East Coast: 0.45 /Mile

- MidWest: 0.43 /Mile

- Gulf Coast: 0.41 /Mile

- Rocky Mountains: 0.46 /Mile

- West Coast: 0.52 /Mile

- California: 0.56 /Mile

Improve now the efficiency of your supply chain.

Book a free consultation with a Fr8App Expert and optimize your results today.

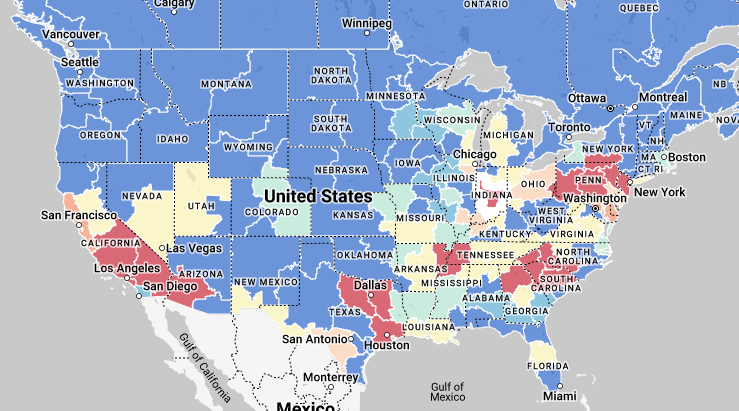

How should I read this map?

- Heat Map shows all markets in the Country and how those markets show where we have capacity rich areas and where we do not. The darker shaded red areas are the “hotter markets” that signifies more freight posted than trucks available in that area. The lighter areas represent more balance in a market for loads per truck.

- Generally, when you are looking at a hotter market, carrier rates inflate from demand. You will see increased rates in a more balanced or lighter market.

A good rule of thumb is…

- A lane from a balanced market to hot market will have stabilized rates.

- A lane from Hot market to a balanced market will have increase.

Key Locations with limited capacity

- Fort Worth, TX 4.1 L/T

- Ontario, CA 4.1 L/T

- Harrisburg, PA 4.0 L/T

- McAllen, TX 4.1 L/T

- El Paso, TX 4.2 L/T

Key Locations with available capacity

- Chicago, IL 1.2 L/T

- Nashville, TN 2.0 L/T

- Atlanta, GA 2.0 L/T

- Laredo, TX 2.4 L/T

- Dallas, TX 2.8 L/T

- Macon, GA 2.9 L/T

Discover exciting stories and get insights from logistics experts.

Join the ultimate Fr8App Insights mailing feed.